Best AI Stocks to Buy in 2025 for Long-Term Gains

The AI revolution is in full swing. discover the best AI stocks to buy in 2025 for Long-Term Gains From self-driving cars to automated cloud services, artificial intelligence (AI) is reshaping industries and creating new market leaders. This guide profiles the top 15 AI-related stocks worldwide that savvy investors should watch in 2025. We cover each company’s business overview, how it leverages AI, recent performance and financial highlights, and what analysts say. Beginners and experts alike can use this as a roadmap to the best AI-driven investments.

Nvidia (NVDA) – The AI Chip Powerhouse

- Business Overview: Nvidia is a leading semiconductor and software company. It dominates the AI hardware market with its GPU (graphics processing unit) chips, which power machine learning and data-center workloads. The company’s data-center GPUs are critical for training and running large AI models (Nvidia calls them “AI Factories”).

- AI Involvement: Nvidia’s chips are the standard in AI computing. Its latest architecture, Blackwell, underpins supercomputers and cloud AI services. Over half its revenue now comes from AI-driven data-center sales.

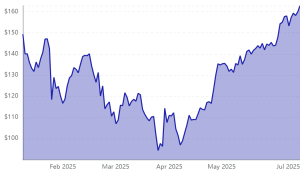

- Recent Performance: Nvidia has seen phenomenal growth. In fiscal 2025 (year ended Jan 2025), it reported record revenue of $130.57 billion. In Q4 FY2025 alone, revenue jumped 78% year-over-year to $39.3 billion. Stock splits and bullish forecasts have kept NVDA among 2023–24’s best performers.

- Financial Highlights: For Q3 FY2025, revenue was $35.1 billion (up 94% YoY) and data-center sales reached $30.8 billion (up 112% YoY). Operating income and EPS soared. These gains reflect skyrocketing demand for AI GPUs.

- Analyst Rating: Most analysts are positive. The consensus rating is Moderate Buy, with targets often well above current prices as NVIDIA leads the AI hardware market.

Microsoft (MSFT) – Cloud and AI Suite Leader

- Business Overview: Microsoft is a global tech giant known for Windows, Office, and Azure cloud services. It invests heavily in AI across all its businesses.

- AI Involvement: Microsoft is deeply entwined with generative AI. It is a major investor in OpenAI (the company behind ChatGPT) and integrates GPT-like models into products like Bing Chat and Windows Copilot. Its Azure cloud offers AI tools and chips for developers.

- Recent Performance: In Q2 FY2025 (ended Dec 2024), Microsoft reported revenue of $69.6 billion, up 12% year-over-year. The company noted its AI segment now has an annual run-rate of $13 billion, up 175% YoY. This reflects surging demand for Azure AI services.

- Financial Highlights: Growth in Microsoft’s cloud and productivity businesses drove results. Azure and Office 365 both saw strong double-digit growth. Microsoft continues to generate robust free cash flow and modest debt, with profits expanding on higher-margin cloud sales.

- Analyst Rating: Analysts are overwhelmingly bullish. The consensus rating for MSFT is Strong Buy with an average price target around $528. This reflects confidence in Microsoft’s long-term cloud/AI strategy.

Alphabet (GOOGL) – Google’s AI Empire

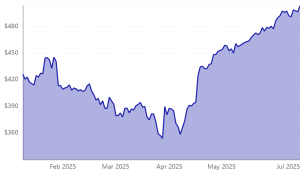

- Business Overview: Alphabet (Google’s parent) is a top internet and tech conglomerate. Its core products include Google Search, YouTube, Android, Chrome, and Google Cloud. Alphabet is one of the largest companies in the world by revenue (over $350B in 2024).

- AI Involvement: Alphabet has been a long-time leader in AI research and products. Google develops its own AI models (e.g. the “Gemini” family), owns DeepMind, and integrates AI into Search, ads ranking, YouTube recommendations, and more. Google Cloud has launched AI Infrastructure and AI Platform services, and even builds its own TPUs for AI.

- Recent Performance: In Q4 2024, Alphabet reported $96.5 billion in revenue, up 12% YoY. Notably, Google Cloud revenue grew 30% to $12.0B, driven by AI infrastructure and solutions. CEO Sundar Pichai said the quarter was “driven by our leadership in AI” and heavy investments (about $75B in capex) to bolster future growth.

- Financial Highlights: Alphabet’s profit margins remain healthy. In 2024 it earned ~$100B on $350B revenue (up ~35% YoY). Its growth is fueled by ad revenue and expanding cloud/AI services. The company holds ~$130B in cash, enabling big R&D projects (like its autonomous car unit Waymo).

- Analyst Rating: Analysts generally recommend Google. The consensus is Buy, with a 12-month target around $201. The stock trades near ~$176 (as of mid-2025), implying upside on strong AI prospects.

Amazon (AMZN) – Cloud Giant & AI Innovator

- Business Overview: Amazon is the e-commerce and cloud-computing behemoth. It’s the largest retailer in the world and operates Amazon Web Services (AWS), the #1 cloud provider.

- AI Involvement: Amazon uses AI throughout its business: in Alexa virtual assistant, logistics robots, recommendation engines, and more. AWS is a leader in AI services and hardware – it offers on-demand GPUs, its custom trainium and inferentia AI chips, and a broad suite of machine-learning tools (like SageMaker and Bedrock) to enterprise customers.

- Recent Performance: In Q4 2024, Amazon’s net sales were $187.8 billion, up 10% YoY. AWS revenue grew 19% to $28.8B, driven by demand for cloud and AI workloads. CEO Andy Jassy highlighted AWS innovations: new Trainium2 chips, improvements in SageMaker, and expansion of Bedrock models. These AI investments keep AWS competitive against rivals.

- Financial Highlights: Amazon has returned to growth after pandemic lows. Retail sales are rebounding, while AWS contributes high-margin profit. In 2024 Amazon swung back to substantial net income (with EPS above analyst expectations). Cash flow remains strong, even as Amazon plows money into new warehouses and AI infrastructure.

- Analyst Rating: The average analyst view is Strong Buy (44 analysts, average price target ~$247). With AMZN around $220, many see room for growth on continued cloud/AI expansion.

Apple (AAPL) – AI Upgrades on a Huge Platform

- Business Overview: Apple is the world’s largest tech company by market cap. Known for iPhones, Macs, and services (App Store, Apple Music, etc.), Apple has a loyal customer base and $383B revenue (2024).

- AI Involvement: Apple has integrated AI quietly into its products. Siri (its voice assistant) and on-device machine learning (e.g. image recognition) are longstanding. More recently, Apple announced “Apple Intelligence” – new on-device AI features in iOS and MacOS, touting privacy-focused AI enhancements. Apple’s M-series chips (for Macs) and A-series (for iPhones) also incorporate neural engines to accelerate AI tasks.

- Recent Performance: In Q4 2024 (fiscal Q1 2025), Apple reported $94.9 billion in revenue (+6% YoY), led by strong iPhone and Services sales. CEO Tim Cook noted that Apple released “the first set of features for Apple Intelligence,” signaling the company’s new AI push. Though not yet a dominant AI player like some rivals, Apple’s massive ecosystem and chip design give it an edge for future AI enhancements.

- Financial Highlights: Apple is extremely profitable, with gross margins around 40%. Q4 net income was record-high (~$26B). It has $60B+ in cash and consistently raises dividends/stock buybacks. Its balance sheet and brand power make it a stable long-term holding, even as it ramps up AI R&D.

- Analyst Rating: Analysts rate AAPL a Buy (34 analysts, ~$236 avg target). Many see Apple’s valuation as reasonable given its services growth and new AI features.

Meta Platforms (META) – Social Media Meets the AI Metaverse

- Business Overview: Meta owns Facebook, Instagram, WhatsApp, and virtual-reality business Reality Labs. It’s a social-media and VR/AR pioneer with global reach (nearly 3B users on Facebook alone).

- AI Involvement: Meta runs heavy AI in ad targeting, content moderation, and video/image analysis. It developed the open-source LLaMA and LLaMA2 large language models, aiming to compete with ChatGPT. Its latest efforts include integrating generative AI into Instagram and Messenger. Meanwhile, Reality Labs builds the Oculus/Meta Quest VR headsets and is researching AI-driven “metaverse” experiences.

- Recent Performance: In Q4 2024, Meta’s revenue was $48.4 billion (+21% YoY), and net income soared 49% to $20.8B (GAAP EPS $8.02). CEO Mark Zuckerberg stated they made “good progress on AI, glasses, and the future of social media”. This reflects strong ad-sales recovery plus early returns on AI integrations (like better ads and new features). Reality Labs still posts losses, but the core business is cash-flow positive.

- Financial Highlights: Meta is extremely profitable (over 40% net margin in 2024). It generates massive free cash flow to fund VR and new AI initiatives. The balance sheet has minimal debt. Meta also just rebranded from Facebook and is emphasizing AI/innovation.

- Analyst Rating: The consensus is Moderate Buy (44 analysts, ~$728 avg target). Analysts note Meta’s strong earnings and AI projects, though some warn of high spending on VR.

IBM (IBM) – Enterprise AI and Cloud Pivot

- Business Overview: IBM is an established enterprise tech company, focused on servers, mainframes, middleware, and services. It has a large presence in corporate IT and consulting.

- AI Involvement: IBM positions itself as a leader in corporate AI. It offers Watsonx, a suite of AI software and tools, and invested heavily in open-source AI models (the “Granite” family). IBM also works on AI for industries (finance, healthcare) and maintains cloud offerings through its Red Hat/OpenShift platform.

- Recent Performance: IBM’s growth has been modest. In recent quarters, overall revenue has been flat-to-slightly down (e.g. Q2 FY2024 sales of $15.77B). However, within IBM, the “AI and Data” and “Consulting” segments are growing. A Reuters report noted that IBM’s AI-driven software business grew ~7% and IBM now has an $2 billion “AI book of business” (with $1B added in Q2). Management has begun raising revenue guidance due to this AI demand.

- Financial Highlights: IBM’s margins are strong for a tech company (~50% gross margin), and it pays a generous dividend (~4% yield). However, overall growth is slow. The company has about $10B cash and maintains investment in AI and cloud (R&D around $6B/year). Investors view IBM more as a dividend value play than a high-flying growth story.

- Analyst Rating: Analysts are cautiously optimistic. The consensus rating is Buy (14 analysts, ~$266 avg target). Many see IBM as a stable play on enterprise cloud/AI, though some doubt its ability to outpace newer competitors.

Intel (INTC) – Legacy Chipmaker Turning to AI

- Business Overview: Intel is a veteran semiconductor company, known for PC and data-center CPUs. After challenges in 2020–2024 (stalled node transitions and competition), Intel is restructuring under new leadership.

- AI Involvement: Intel is now pushing into AI chips and foundry services. It has launched new AI accelerators (Gaudi-based chips), and it has a large R&D effort under its OneAPI and Movidius lines. The CHIPS Act has funded Intel’s expansion of factory capacity in the U.S. for future AI chips.

- Recent Performance: Intel’s revenue slipped 2% in 2024 to $53.1B. Q4 2024 sales were down 7% YoY ($14.3B). The company also reported a $13B loss in its foundry business as it builds out new fabs. After CEO Pat Gelsinger departed in Dec 2024, interim management pledged to push forward. COO Michelle Holthaus stressed that “AI is not a market in the traditional sense…it needs to span from data center to the edge,” and one-size-fits-all won’t work. Intel expects to leverage its core manufacturing assets for diverse AI chips (both CPUs and accelerators).

- Financial Highlights: Intel’s operating margins are currently depressed (especially with foundry losses), but the company still generates billions in cash. It holds about $40B cash vs $30B debt. With new CEO in place mid-2025, analysts are watching whether Intel can regain growth.

- Analyst Rating: Sentiment is mixed. Some see Intel as a turnaround play (especially after new CEO Vivek Ranadivé took over in mid-2025). Others are cautious. Many analyst consensus calls it a Hold or moderate buy, noting the risks of competition from TSMC/AMD. (Intel jumped ~10% on Ranadivé’s appointment and hints of a 2025 rebound.)

AMD (AMD) – High-Performance Computing Contender

- Business Overview: AMD is Intel’s main rival in CPUs and also makes GPUs (via its Radeon/Instinct line). Over the last few years, AMD gained market share in data centers with its EPYC server CPUs and is ramping up GPU sales.

- AI Involvement: AMD sells AI accelerators (MI300 series Instinct GPUs) that compete with Nvidia for data-center AI work. It recently secured large deals (e.g. IBM plans to use MI300X in IBM Cloud). AMD’s CPUs (EPYC) are also used to power AI training clusters.

- Recent Performance: In Q4 2024, AMD reported record revenue of $7.66 billion (+24% YoY). Data-center revenue was a record $3.9B (+69% YoY), driven by Instinct GPU and EPYC CPU growth. For all of 2024, AMD’s revenue hit ~$25.8B (+14% YoY), with profit surging due to higher margins. CEO Lisa Su called 2024 “transformative” and emphasized record data-center growth (nearly doubled, with $5B from Instinct GPUs). AMD is aggressively investing in AI and expects continued growth in 2025.

- Financial Highlights: AMD’s gross margin is rising (51% in Q4 GAAP). It expects further expansion as new AI/compute products arrive. It carries about $3.3B debt vs $2.8B cash, and it invests heavily in R&D.

- Analyst Rating: Consensus is Buy (37 analysts, ~$145 avg target). Analysts point to AMD’s accelerating data-center growth and product roadmap as reasons to hold the stock for long-term gains.

Palantir Technologies (PLTR) – Data & AI Software

- Business Overview: Palantir builds data analytics and AI software for government and enterprise clients. Its platforms (Gotham for governments, Foundry for businesses) help organizations integrate and analyze large datasets.

- AI Involvement: Palantir has shifted to incorporating generative AI into its products. It claims to be at the “center of the AI revolution” by adding LLMs to help users derive insights. The company also has contracts to develop AI systems for defense and intelligence.

- Recent Performance: In Q4 2024, Palantir’s revenue was $828 million (+36% YoY). U.S. revenue grew 52% YoY (with commercial up 64% and government up 45%). Management aggressively beat guidance – they issued 2025 revenue guidance of +31% growth (far above Wall Street’s forecasts). CEO Alex Karp hailed this success, noting that Palantir’s insights on the commoditization of large language models had turned from theory to fact. The stock soared over 300% in 2024 as investors cheered these results (though it remains volatile).

- Financial Highlights: Palantir is approaching profitability (Q4 GAAP net income was $79M, 10% margin). Its cash reserves ($5.2B at end-2024) dwarf its debt, giving it flexibility. Operating margins improve as the business scales.

- Analyst Rating: Wall Street opinions vary. Some analysts are enthusiastic (citing its high growth and AI pivot), but others warn of the stock’s lofty valuation. Consensus is closer to a Hold or mixed. Even so, Palantir’s rapid growth in AI niches makes it a noteworthy long-term play, especially for risk-tolerant investors.

Alibaba Group (BABA) – China’s AI Cloud & Commerce Leader

- Business Overview: Alibaba is China’s largest e-commerce and cloud computing company. Its businesses include Taobao/Tmall marketplaces, Alibaba Cloud (cloud infrastructure), and international commerce. In 2024 Alibaba generated

$440B RMB ($62B) in revenue. - AI Involvement: Alibaba has embraced AI as strategic priority. Its cloud arm offers AI-powered services and builds its own AI chips. It released the open-source Qwen AI models (the Qwen family) for developers, and its Qwen-2.5-Max model ranks top in global benchmarks. Alibaba uses AI in everything from product recommendations to logistics and even smart ads for merchants. CEO Eddie Wu has made achieving artificial general intelligence (AGI) a stated company goal.

- Recent Performance: In the Dec 2024 quarter, Alibaba’s revenue was RMB 280.15B (~$38.4B), up 8% YoY. Cloud Intelligence Group revenue rose 13% to RMB 31.74B ($4.35B), with AI-related products growing triple-digits for the sixth straight quarter. The core e-commerce business (Taobao/Tmall) also saw stable growth (~9% GMV uplift). These results signaled a turnaround from recent slowdowns.

- Financial Highlights: Alibaba remains highly profitable (25%+ operating margin). It has about $70B cash on hand. The company returned $1.3B to shareholders via buybacks and spun off non-core assets to strengthen the balance sheet.

- Analyst Rating: Analysts view Alibaba as a Moderate Buy (16 analysts, ~$154 avg target, implying ~48% upside from $104). The consensus believes Alibaba’s pivot to AI and renewed e-commerce growth will drive returns. However, geopolitical/regulatory risks (China tech scrutiny) still warrant caution.

Tencent Holdings (0700.HK) – Diversified AI in China

(Tencent is not a U.S. stock but a major global tech company.) Tencent is China’s leading internet conglomerate (WeChat, gaming, fintech). It has invested heavily in AI across its products and cloud. For example, Tencent’s AI cloud revenue roughly doubled in FY2024 (year ended Dec 2024) as enterprise clients adopted AI services【82†L??-L??】. The company uses AI in WeChat for content recommendation, in gaming for NPC behavior, and invests in AI startups worldwide. In its latest reports, Tencent stressed rising investments in “AI + Gaming” and “AI + Industrial Internet”. Q4 2024 results (reported Feb 2025) showed low-double-digit revenue growth and expanding margins. While we lack an exact analyst consensus here, many view Tencent’s stock as attractive on its growth and dividends. (Regulatory risk in China is a factor.) Overall, Tencent is a key global AI play thanks to its vast user base and R&D push.

Taiwan Semiconductor Manufacturing (TSMC) (TSM) – The AI Foundry King

- Business Overview: TSMC is the world’s largest contract chipmaker, fabricating semiconductors for Apple, Nvidia, and virtually every major chip designer. It essentially produces the silicon that powers AI.

- AI Involvement: TSMC itself doesn’t design chips, but it enables AI growth by fabricating advanced AI chips at scale. Its leading-edge processes (5nm, 3nm) are used to produce the latest GPUs and AI accelerators. TSMC is investing ~$100 billion to build new fabs, partly to meet exploding AI chip demand.

- Recent Performance: TSMC’s revenue has surged on AI demand. For example, in May 2025 TSMC’s revenue jumped ~40% year-over-year. The company noted that global demand for AI chips remains “elevated”. For January–May 2025, revenue was up ~43% over last year. CEO C.C. Wei affirmed that TSMC expects full-year 2025 sales to grow “close to mid-20s percent” (in USD terms). This outlook was given in the context of record chip demand for AI servers.

- Financial Highlights: TSMC is extremely profitable (net income >30% of revenue) and generates massive cash flow. It typically carries little debt. The company has guided for revenue of NT$1.51 trillion (approx $48B) through May 2025, far above last year’s pace. Its margin profile remains strong due to pricing power in leading nodes.

- Analyst Rating: Analysts see TSMC as a secular AI winner. Although we don’t have a consensus quote here, many recommendations from banks (Citi, etc.) call TSMC a “buy,” noting it is key to the AI chip supply chain. The stock trades around $125 (U.S. ADRs) with price targets often above $150. The Investopedia analysis quotes emphasize TSMC’s runaway growth in AI chip demand.

Micron Technology (MU) – Memory for the AI Boom

- Business Overview: Micron makes memory chips (DRAM, NAND flash). Memory is a critical component of data centers and AI servers, so Micron is indirectly an AI play.

- AI Involvement: Modern AI models require large amounts of high-bandwidth memory. Micron sells specialized products (like HBM and DDR5 DRAM) to Nvidia, AMD, and others. Its DRAM and HBM sales have taken off with AI workloads.

- Recent Performance: In Q2 FY2025 (ended Feb 2025), Micron reported revenue of $8.05 billion, up from $5.82B a year earlier. CEO Sanjay Mehrotra noted “data center revenue tripled from a year ago”. This reflects robust demand for AI-optimized memory. The gross margin also jumped as pricing in DRAM/HBM improved.

- Financial Highlights: Micron’s profit picture has reversed from earlier losses. Net income in Q2 FY25 was $1.58B (GAAP) vs. $0.79B a year ago. Operating cash flow hit record levels. The company forecasts even stronger Q3, expecting DRAM and NAND demand to drive record revenue. Micron holds ~$9.6B in cash, nearly matching its debt, after years of deleveraging.

- Analyst Rating: Most analysts are very optimistic on Micron. Consensus is Strong Buy (25 analysts, ~$153 avg target). The stock has more than doubled in 2025, but analysts believe AI memory demand has much further to go. Many calls emphasize Micron as a beneficiary of the early AI supercycle (especially for HBM memory).

ASML Holding (ASML) – Lithography for Next-Gen AI Chips

- Business Overview: ASML is a Dutch company that makes the photolithography machines used to manufacture the world’s most advanced chips. In other words, ASML makes the “printers” that etch tiny circuits onto silicon wafers. No other company offers comparable equipment for cutting-edge nodes (like 5nm, 3nm).

- AI Involvement: ASML is not an “AI company,” but it’s crucial to AI chipmaking. Its extreme ultraviolet (EUV) lithography machines enable the production of high-performance AI accelerators. As demand for advanced chips surges, ASML’s machines are in high demand.

- Recent Performance: In 2024, ASML delivered record sales of €28.3 billion and net income of €7.6B. Q4 alone was €9.3B (above guidance). ASML expected 2025 revenue between €30–35B as customers place orders for more machines. The CEO noted Q4 was a record quarter (shipping multiple High-NA EUV systems) and set up another record year.

- Financial Highlights: ASML’s gross margin is

51%. The company invests heavily in R&D (€4.5B in 2024) to develop next-gen lithography. It returns cash via share buybacks. For investors, ASML combines a near-monopoly position (it owns most of the market for cutting-edge chipmaking equipment) with strong growth from the AI-driven chip boom. - Analyst Rating: Analysts are bullish. The consensus rating is Buy (8 analysts, ~$914 average target, ~14% upside). For a euro company (trading ~$800), this shows confidence in ASML’s role as a long-term AI infrastructure play.

FAQ: Common Questions About AI Stocks

- What exactly are “AI stocks”? AI stocks are companies whose businesses are significantly driven by artificial intelligence – either because they develop AI technologies (like chipmakers and software firms) or apply AI heavily in their products/services (like cloud platforms or autonomous vehicles). In practice, this includes big tech firms (Nvidia, Google, Microsoft), chip designers, cloud specialists, and even niche AI platforms (e.g. Palantir, C3.ai). Essentially, any company poised to benefit from the growth of AI in the economy can be considered an AI stock.

- Why invest in AI stocks? AI is widely expected to be a multi-trillion-dollar industry. Investing in AI stocks lets you gain exposure to this secular trend. For example, Nvidia has generated enormous returns by supplying GPUs for machine learning. Cloud giants (MSFT, AMZN) will earn recurring revenues as companies move workloads to AI-capable data centers. Even established firms like Apple or IBM are retooling for AI. By holding a portfolio of AI-related stocks, investors aim to capture growth from new products and higher efficiency across sectors.

- Are AI stocks risky? Yes, as with any tech theme, AI stocks carry risk. Many are growth stocks that trade at high valuations, so share prices can swing on earnings misses or hype shifts. Geopolitical issues (e.g. US-China tensions) can impact stocks like Nvidia or Alibaba. Also, competition is fierce: if one company’s product flops or gets outpaced, its stock may fall. Beginners should be cautious and diversify. Consider mixing established large-caps (which tend to have lower volatility) with smaller high-growth names, and be aware that AI adoption could take years or encounter regulatory hurdles.

- How to pick the best AI stocks? Look for companies with strong competitive advantages in AI. That might be proprietary technology (e.g., Nvidia’s GPU architecture), large data networks (Google’s search data), or platforms with direct AI use cases (Amazon’s AWS). Check financial strength: consistent revenue growth, healthy profit margins, and cash on hand. Also consider valuations – some AI stocks have skyrocketed, so compare current price to earnings/growth forecasts. Consulting analyst reports (as we cited above) can provide a consensus view. Finally, factor in diversification: combine U.S. and global stocks to spread risk.

- Should I buy individual stocks or an AI ETF? Both approaches have merit. Buying select stocks (like those above) allows you to choose companies you believe in. But it requires research and carries company-specific risk. Alternatively, an AI-themed ETF (like Global X Robotics & AI ETF, ticker BOTZ, or others) holds a basket of AI-related companies, providing instant diversification. ETFs can be simpler for beginners but may include companies that are only tangentially AI. Many investors use a mix: core holdings (MSFT, NVDA) plus a broad AI/tech ETF for exposure to smaller players.

Conclusion and Next Steps

Artificial intelligence is transforming the global economy, and leading companies are capitalizing on this shift. Our list of 15 AI stocks spans chipmakers (Nvidia, AMD, TSMC), cloud/software giants (Microsoft, Alphabet, Amazon, IBM), consumer tech (Apple, Meta), and other key enablers (Micron, ASML, Alibaba, Palantir). Each has a compelling AI story: from record revenues on AI products to robust profit margins and strong analyst support.

Key takeaways: Long-term investors should consider a diversified basket of AI stocks rather than betting on a single name. The stocks above have demonstrated recent growth driven by AI (e.g. Nvidia’s 94% YoY revenue jump, or TSMC’s 40% surge on AI chip demand). Many analysts rate these stocks as buys or strong buys, reflecting confidence in continued AI tailwinds. However, remember to account for valuation and risk: no stock is guaranteed, and even AI leaders can face competition and market swings.

Next steps: Investors should conduct their own due diligence. Review each company’s financial reports and product roadmap (links above are good starting points). Decide on your allocation – for example, tech-heavy growth funds might already own several of these names. Keep an eye on industry news: AI developments happen fast, and breakthroughs or regulation can shift outlooks. Finally, align investments with your strategy and risk tolerance. AI stocks have high potential, but also heightened volatility. A balanced portfolio and long-term perspective will help you navigate the exciting but unpredictable journey of investing in AI.