Which Personal Finance App Is Best for Money Making This Year?

You have the right to ask someone or search which personal finance app is best for money making this year , When it comes to building wealth and managing money wisely, that’s the first to be sure of and when you do, then get the app into your phone. Before now in 2025, several apps have stood out for their ability to not only help users save and budget, but actively make money too.

But with so many apps on the market, how do you know which one is the best for money making this year? We have broken down the top contenders to help you choose the right app based on your financial goals.

Here are listed best apps and thoroughly explained the uses, the pros and cons of each, what you stand to lose or gain.

Acorns– Best for Passive Investing

Why it’s great for money making:

Acorns rounds up your spare change from everyday purchases and invests it automatically. Over time, these micro-investments can grow significantly thanks to compound interest. which personal finance app is best for money making this year .

Key Features:

- Automatic investing in diversified portfolios

- Found Money (cash-back offers from partners)

- Retirement and checking account options

Pros:

- Automatic investing from spare change makes it beginner-friendly

- Easy-to-use interface with minimal setup

- Offers retirement (IRA) and checking account options

- Found Money feature provides extra cash-back opportunities

Cons:

- Monthly fees can outweigh returns for small account balances

- Limited customization of investment portfolios

- Not ideal for active investors or those wanting control over trades

Cost:

- Starts at $3/month for personal accounts

- $5/month for family accounts (includes kids’ accounts and more tools)

Availability:

- Available on iOS, Android, and web

- U.S. only

Standout Features:

- Automatic round-up investing

- Found Money (cash-back from partner brands)

- Access to retirement and checking accounts

Security Features:

- 256-bit encryption

- Multi-factor authentication

- SIPC-insured investment accounts

Best for: People who want a hands-off way to grow their money passively.

Robinhood – Best for Stock and Crypto Trading

Why it’s great for money making:

- Robinhood gives users commission-free access to trade stocks, ETFs, and cryptocurrencies. It’s ideal for those looking to build wealth through active investing or swing trading.

Key Features:

- Zero-commission trading

- Real-time market data and alerts

- Access to fractional shares and crypto

Pros:

- Commission-free trading on stocks, ETFs, and crypto

- Simple and clean user interface

- Offers fractional shares for smaller investments

- Real-time market data and alerts

Cons:

- Encourages high-risk trading behavior among beginners

- Limited in-depth financial planning tools

- Customer support can be slow or limited

- Not ideal for long-term, passive investors

Cost:

- Free to use for trading

- Robinhood Gold (advanced features) costs $5/month

Availability:

- iOS, Android, and desktop

- U.S. residents only

Standout Features:

- Commission-free stock, ETF, and crypto trading

- Fractional shares

- Instant deposit and real-time data

Security Features:

- Biometric login options

- 2-factor authentication

- SIPC insurance for brokerage accounts

- Industry-standard encryption

Best for: Active investors who are comfortable with market risks and want to grow wealth through trading.

YNAB (You Need A Budget) – Best for Smart Budgeting That Builds Savings

Why it’s great for money making:

YNAB isn’t an investment platform, but its budgeting strategy helps users save aggressively, freeing up money that can then be invested or used to pay down debt faster.

Key Features:

- Goal-oriented budgeting

- Real-time tracking and sync with bank accounts

- Educational resources and workshops

Pros:

- Proven budgeting method that helps users gain financial control

- Helps break paycheck-to-paycheck cycle

- Syncs with bank accounts and credit cards

- Excellent educational content and community support

Cons:

- Monthly or annual subscription required

- Learning curve for new users unfamiliar with budgeting techniques

- No direct investing or income generation features

Cost:

- $14.99/month or $99/year (free 34-day trial)

Availability:

- iOS, Android, web, and desktop app

- Global (currency customization supported)

Standout Features:

- Zero-based budgeting system

- Real-time bank syncing

- Goal tracking and reporting

Security Features:

- Bank-level encryption

- Data never sold or shared

- 2FA available

Best for: Budget-conscious users who want to get out of debt and allocate more money toward investing or earning.

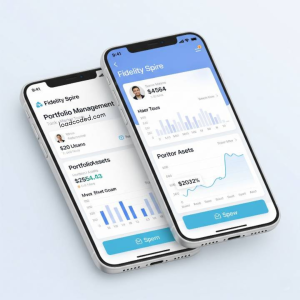

Fidelity spire- Best for Goal-Based Investing

Why it’s great for money making:

This app helps users set financial goals and reach them through smart investing. With no account minimums and access to Fidelity spire wide range of investment products, it’s a great starting point for long-term wealth building.

Key Features:

- Goal tracking (e.g., travel, emergency fund, retirement)

- Educational tools to learn investing

- Commission-free trades

Pros:

- Goal-based approach helps with long-term planning

- Backed by Fidelity’s trusted financial services

- No account minimums; great for beginners

- Offers commission-free stock and ETF trades

Cons:

- More limited than Fidelity’s full app (Spire is simplified)

- Not ideal for advanced investors needing complex tools

- Educational content is solid but basic for experienced users

Cost:

- Free to use

- No account minimums

- Commission-free trades on stocks and ETFs

Availability:

- iOS and Android

- U.S. only

Standout Features:

- Goal-based saving and investing

- Integration with Fidelity investment products

- Educational tools for new investors

Security Features:

- Strong encryption

- FDIC and SIPC insurance

- Multi-factor authentication

Best for: Beginners looking for structured guidance toward financial goals.

Side Hustle by Steady – Best for Earning Extra Income

Why it’s great for money making:

Steady connects users to gig jobs, freelance work, and side hustles that match their skills and availability. It’s more of an income-earning tool than a traditional finance app.

Key Features:

- Personalized job recommendations

- Income tracker and insights

- Cash bonus incentives from certain gigs

Pros:

- Helps users find freelance, part-time, or gig work easily

- Tracks income across multiple streams

- Offers cash incentives and bonuses for certain gigs

- Ideal for low-income or underemployed users

Cons:

- Doesn’t manage or grow money only helps find ways to earn it

- Job quality and availability can vary by location

- No budgeting, investing, or financial planning tools

Cost:

- Free to use

- Some premium features or offers may come with optional fees

Availability:

- iOS, Android, and web

- U.S. only

Standout Features:

- Side hustle and gig job discovery

- Income tracker

- Personalized job matches and bonus offers

Security Features:

- Encrypted data transfer

- Does not store bank credentials

- Privacy-focused user data protection

Best for: People looking to boost their income quickly and explore new earning opportunities.

Best budgeting apps of 2025

You Need a Budget (YNAB)

Why it stands out: A fan-favorite among hands‑on budgeters using the zero‑based method every dollar is assigned a job. Users report that it changes spending habits by design.

Cost: Free 34‑day trial; then $14.99/month or $109/year; free for students for one year.

Best for: People who want full control and learn to plan ahead .

Monarch Money

Why consider it: Offers both flexible high-level budgeting and detailed category tools. Includes net worth tracking, bill reminders, and easy household account sharing.

Cost: Free 7‑day trial; $14.99/month or $99.99/year.

Best for: Households or those working with financial advisors seeking deep insights .

PocketGuard

Why it matters: Instantly calculates what you can spend after accounting for bills and savings. Includes debt reduction tools for premium users.

Cost: Free basic version; $12.99/month or $74.99/year for PocketGuard Plus.

Best for: Beginners or anyone focused on debt management .

Simplifi by Quicken

What makes it great: Beginner-friendly interface, future cash flow forecasting, and a new “LifeHub” document center.

Cost: $2.99/month, billed annually.

Best for: Users looking for simplicity with smart automation and forecasting tools .

Honeydue

Why couples love it: Built for sharing and tracking joint spending while keeping individual accounts private. Integrated chat helps partners coordinate budgets.

Cost: Free to use.

Best for: Couples who want streamlined, shared financial visibility .

EveryDollar

Why it’s notable: A straightforward zero‑based budgeting tool by the folks at Ramsey Solutions. Free version is manual entry only, premium adds bank syncing.

Cost: Free version available; premium with syncing costs extra.

Best for: Users familiar with the Ramsey envelope system or preferring a simpler UI .

Goodbudget

How it works: Virtual envelope budgeting—manually allocate your income into categories, track spending, and plan ahead. Syncing requires a paid plan.

Cost: Free plan with limits; premium starts at $10/month or $80/year.

Best for: Users who want envel

ope-style budgeting without linking bank accounts .

What Is a Budgeting App?

A budgeting app is a digital tool designed to help individuals manage their finances more effectively. These apps allow users to track income, monitor spending, set financial goals, and create customized budgets. Whether it’s for daily expenses, saving for a big purchase, or paying off debt, budgeting apps provide real-time insights into where your money goes. Many apps connect directly to your bank accounts and credit cards, offering automated tracking and personalized recommendations based on your financial habits.

What to Look for in a Budgeting App

When choosing a budgeting app, it’s important to consider features that align with your financial goals and lifestyle. Look for an app with a user-friendly interface, automatic bank synchronization, customizable budget categories, and detailed reports. Security is also crucial, so opt for apps that offer encryption and two-factor authentication. Some apps focus more on tracking expenses, while others are better for setting savings goals or managing debts. Consider whether you need support for multiple users, bill reminders, or investment tracking. Lastly, check if the app is free or subscription-based, depending on your budget.

How to Create a Budget

Creating a budget starts with understanding your income and expenses. Begin by calculating your total monthly income, including salary, freelance work, and passive income. Next, list all monthly expenses, such as rent, groceries, transportation, entertainment, and savings. Categorize your spending and identify areas where you can cut back. Set realistic goals, like reducing dining out or increasing your emergency fund. Then, assign spending limits to each category based on your priorities. Regularly reviewing and adjusting your budget is key to staying on track.

5 Best Budgeting Strategies

The 50/30/20 Rule

This method allocates 50% of your income to needs (housing, bills), 30% to wants (entertainment, travel), and 20% to savings and debt repayment. It offers a simple framework to balance essential and discretionary spending.

Zero-Based Budgeting

In this strategy, every dollar of your income is assigned a purpose—whether it’s spending, saving, or investing—so your income minus expenses equals zero. It encourages accountability and full control of your money.

Envelope System

Originally a cash-based method, the envelope system involves assigning cash amounts to different spending categories. Once the envelope is empty, you can’t spend more in that category. Some budgeting apps now simulate this system digitally.

Pay Yourself First

This strategy prioritizes savings by automatically transferring a portion of your income into savings or investments before any other expenses are paid. It ensures that financial goals are met before discretionary spending occurs.

Value-Based Budgeting

Instead of restricting spending, this method encourages you to spend intentionally on what matters most to you. By aligning spending with personal values and long-term goals, budgeting feels more meaningful and sustainable.

Final Thoughts

The best personal finance app for making money in 2025 depends on your financial habits, goals, and risk tolerance. If you’re looking for passive income, Acorns is a strong choice. For active traders, Robinhood offers flexibility. Want to save smarter? YNAB might be your go-to. For those who need a clear investment roadmap, Fidelity Spire is ideal. And if you just need to earn more now, Steady can connect you with new income sources.

So no matter which app you choose, the key is to take action whether it’s saving more, investing smarter, or earning on the side.

I’m glad you could read down to the end, tell me was I able to answer your questions? If you do follow for more related search, thank you.

![Top 10 Easy Ways A Beginner Can Make Money Online With SEO in 2025 [Proven Strategies] 22 IMG 20250727 WA0060](https://loadcoded.com/wp-content/uploads/2025/07/IMG-20250727-WA0060-150x150.jpg)