What is Market Cap in Cryptocurrency?

If What is Market Cap in Cryptocurrency? is what brought you here discover what it means in cryptocurrency, how it’s calculated, and why it’s vital for investors. Learn how market cap helps compare coins and assess investment potential in crypto.

What is Market Cap in Cryptocurrency?

Understanding the Concept of Market Capitalization

Market capitalization, commonly known as market cap, refers to the total estimated value of a cryptocurrency in circulation. It’s a metric that helps investors understand the relative size and value of a particular coin within the broader market.

How is Crypto Market Cap Calculated?

To determine a cryptocurrency’s market cap, multiply the current price of one unit of the coin by the total number of coins currently in circulation.

Formula:

Market Cap = Current Coin Price x Circulating Supply

Example:

If a coin is priced at $20 and there are 10 million coins circulating, the market cap would be:

$20 x 10,000,000 = $200,000,000

This formula helps gauge how valuable a cryptocurrency is as a whole, not just how much a single unit is worth.

<<<What is Market Cap in Cryptocurrency? Continue Reading>>>

Market Cap in Traditional Stocks vs. Cryptocurrency

In traditional finance, market cap refers to the total value of a company’s shares:

Stock Price x Number of Outstanding Shares

In the world of crypto, the concept is similar, but it’s based on digital coins instead of company shares. For example:

- Bitcoin: Circulating supply is ~19.7 million coins

- Ethereum: Circulating supply is ~120 million coins

If Bitcoin trades at $30,000, its market cap is roughly:

$30,000 x 19,700,000 = $591 Billion

Circulating Supply vs. Fully Diluted Supply

You may hear about two types of market caps:

Circulating Supply Market Cap

This is the most common metric — calculated based on the coins currently available in the market.

Fully Diluted Market Cap

This considers the maximum supply that will ever exist. For example, Bitcoin will never exceed 21 million coins. So its fully diluted market cap assumes all coins have already been mined.

Example:

- Circulating Supply: 19.7 million

- Total Maximum Supply: 21 million

- If BTC is $30,000:

- Circulating Market Cap = $591 Billion

- Fully Diluted Market Cap = $630 Billion

Different investors may choose either metric based on their analytical goals.

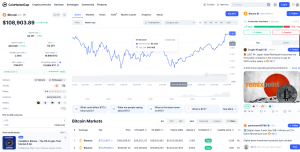

<<<What is Market Cap in Cryptocurrency? Still On Subject Topic- Below is image Sample >>>

Why Market Cap Matters in Crypto

1. True Valuation Beyond Coin Price

The coin’s price alone can be misleading. A coin valued at $10 with a 1 billion coin supply ($10B market cap) is larger in market value than a coin at $200 with a 10 million supply ($2B market cap).

Example Comparison:

| Coin | Price | Circulating Supply | Market Cap |

|---|---|---|---|

| Coin X | $1 | 500 million | $500M |

| Coin Y | $2 | 100 million | $200M |

Although Coin Y has a higher price per unit, Coin X has a higher market cap, meaning it’s technically more valuable overall.

2. Indicator of Stability and Risk

Larger market cap coins like Bitcoin and Ethereum are generally considered more stable and less volatile. Smaller-cap coins tend to experience bigger swings — both gains and losses — due to limited liquidity and market speculation.

Categories of Cryptocurrencies by Market Cap

Cryptocurrencies are commonly categorized into three tiers based on market capitalization:

1. Large-Cap Cryptocurrencies (Over $10 Billion)

These are industry giants like:

- Bitcoin (BTC) – $1.3 Trillion (as of early 2024)

- Ethereum (ETH) – $390 Billion

Why they matter:

They have a solid track record, greater liquidity, and more adoption. Though not immune to price drops, they’re often seen as relatively safer long-term investments.

2. Mid-Cap Cryptocurrencies ($1 Billion to $10 Billion)

These include popular altcoins like:

- Polygon (MATIC)

- Chainlink (LINK)

Traits:

- Moderate risk and reward

- Potential for high growth

- Can be volatile but less risky than small-cap coins

3. Small-Cap Cryptocurrencies (Under $1 Billion)

These are emerging or niche coins like:

- Fantom (FTM)

- Arweave (AR)

Traits:

- High risk, high reward

- Can see wild price fluctuations

- Susceptible to market hype or manipulation

How to Use Market Cap in Your Investment Strategy

Market cap is a guiding metric — not a definitive investment signal. Here’s how to make use of it:

A. Evaluate Relative Value

By comparing market caps, you can determine which coin has more dominance or perceived value in the market.

B. Manage Risk

Generally, large-cap assets carry less risk, while small-cap coins offer speculative opportunities but with higher risk. Depending on your risk appetite, you may allocate accordingly.

C. Diversify Based on Cap Size

Create a balanced portfolio:

- 60% Large-cap (BTC, ETH)

- 30% Mid-cap (SOL, AVAX)

- 10% Small-cap (emerging altcoins)

Limitations of Using Market Cap Alone

While market cap is helpful, it shouldn’t be the only metric you consider.

Factors to Combine with Market Cap:

- Trading volume

- Development activity

- Community support

- Tokenomics (supply model)

- Liquidity

A high market cap doesn’t guarantee future success — always consider the bigger picture.

FAQs About Crypto Market Cap

Q1: Can a low-priced coin have a high market cap?

Yes. If there are billions of coins in circulation, even a low-priced coin can have a massive market cap.

Q2: Is market cap the same as value?

Not exactly. Market cap shows current market valuation, but it doesn’t account for development progress, usability, or future growth potential.

Q3: Can the market cap of a coin change daily?

Absolutely. Since it depends on coin price and circulating supply, even small price changes can alter the market cap.

Q4: Which is better – a coin with a high price or high market cap?

Market cap is generally more insightful for comparing cryptocurrencies. A higher coin price doesn’t always indicate higher overall value.

Q5: What causes a market cap to rise or fall?

Mainly price changes, but also supply changes (e.g., new coins being released or burned).

Conclusion: Why Market Cap is Crucial for Crypto Investors

Market capitalization is a foundational concept in crypto investing. It helps you:

- Understand the size and strength of a coin

- Compare one cryptocurrency against another

- Evaluate potential risks and rewards

But it’s just one piece of the puzzle. Always combine it with other metrics, research, and your personal risk profile. A smart investor uses market cap to gain clarity — not certainty — when navigating the dynamic world of crypto and perhaps coinbase also have an article on what is market cap in cryptocurrency?, you might want to explore more.